Customer-Related Data Quality Pain in Early Survey Results

We have an early yet strong indication of customer-related data quality issues across the full size range of organizations responding to our Poor Data Quality Survey. While there are many other areas of inquiry within our survey, I’ve selected customer data quality for this review because of its universality. Every business needs, and hopefully values their customers. However, despite all the talk about “knowing your customer” and the ascendancy and near-universality of customer relationship management (CRM), our respondents say that their customer-related data quality is sub-par and that has real dollar costs.

Strong and Rapid Response Suggests we Struck a Nerve

At the time of this writing, the survey, developed by the consortium of Principal Consulting, Robert Frances Group, Chaordix, and the IBM InfoGov Community has been in flight for two weeks, and has 88 completed responses with another 40 in the pipeline. Given the early August launch, with summer and vacation on people’s minds, the extent of this survey response suggests that Poor Data Quality leading to Negative Business Outcomes has struck a raw nerve. You can read about the survey launch, and many prior posts on the survey, starting here.

Customer-Related Data Quality Issues Caused Lost Business

Our survey respondents were unanimous about the existence of poor customer-related data quality and told us about the problems they experiences, the likely causes, and the monetized cost of those problems. I’ve prepared several graphs that I’ll present following, with minimal commentary. The results largely speak for themselves. Click on the graphs to see a full size version.

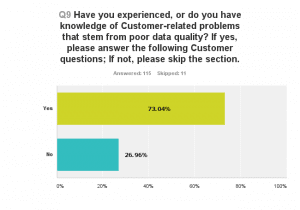

As shown in the analysis of survey question 9,

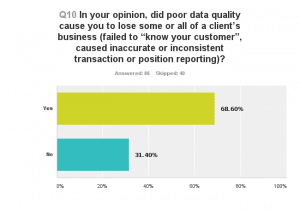

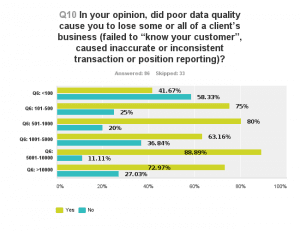

As shown in the analysis of survey question 9,  more than 70% of the respondents either customer-related data problems or knew of such problems in their organization. Question 10 responses show more than 68% of respondents believed their organization lost client business because of poor customer-related data quality.

more than 70% of the respondents either customer-related data problems or knew of such problems in their organization. Question 10 responses show more than 68% of respondents believed their organization lost client business because of poor customer-related data quality.

Let’s look at question 10 responses broken down by business size. Bad news… nearly 89% of respondents working for businesses in the 5,000 -10,000 employee size are reporting losses due poor customer-related data quality. Only for the smallest business in the survey did fewer than 50% of respondents report customer data-related losses.

Poor Customer-Related Data Quality Made Customer Acquisition & Retention More Costly

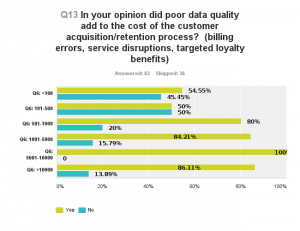

As shown in the Question 13 graph, the 5,000 – 10,000 employee-sized businesses lead  the way again, with 100% of respondents indicating that poor customer-related data added to the cost of acquiring and/or retaining their customers. In no business size category did less than 50% of respondents affirm additional customer acquisition and retention costs.

the way again, with 100% of respondents indicating that poor customer-related data added to the cost of acquiring and/or retaining their customers. In no business size category did less than 50% of respondents affirm additional customer acquisition and retention costs.

Similar Causes Cited for Poor Customer-Related Data Quality and Poor Data Quality Overall

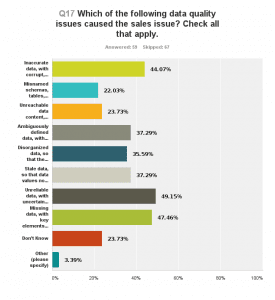

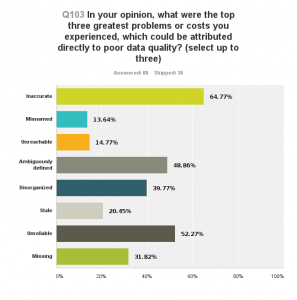

Inaccurate, unreliable, ambiguously

Inaccurate, unreliable, ambiguously  defined, and missing data lead the causes cited by respondents when asked about poor customer-related data quality (left graphic), and when asked about the top three causes of poor data quality across all survey problem reporting areas.

defined, and missing data lead the causes cited by respondents when asked about poor customer-related data quality (left graphic), and when asked about the top three causes of poor data quality across all survey problem reporting areas.

These are fumbles in basic data quality blocking and tackling.

Respondents Estimated the Cost of Poor Customer-Related Data Quality

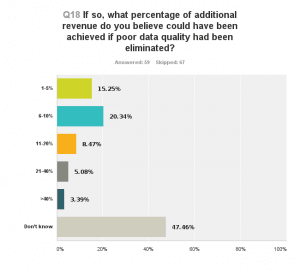

A key driver of our survey effort is putting a monetized value on the cost of poor data quality. Therefore, we asked our respondents to estimate the cost, loss in value, or similar concept that resulted from poor data quality, or the increase in profit or value that would result if poor data quality were avoided.

A key driver of our survey effort is putting a monetized value on the cost of poor data quality. Therefore, we asked our respondents to estimate the cost, loss in value, or similar concept that resulted from poor data quality, or the increase in profit or value that would result if poor data quality were avoided.

More than half our respondents offered a monetized estimate to our question about additional revenue that might have been realized if poor customer-related data quality had been eliminated. Over 15% of respondents believed that up to 5% more revenue might have been attained if poor customer data quality issues were eliminated. An additional 20% believed that between 6% and 10% more revenue might have been attained.

What could 6% more revenue mean in real dollars?

So, let’s say a 1 billion dollar company fixed its customer-related data quality issues and attained a 6% revenue increase. That would mean $60,000,000 in additional revenue. It might cost that company about $3,000,000 to obtain and implement data quality tooling and services to make that fix. That’s a 1900% Return on Investment.

Given numbers like these, is it really possible that IT organizations haven’t been able to sell their business colleagues on data quality investments? That sounds improbable, yet it appears to be true. Remember, this is just the customer-related data. There are 12 other functional business area on our survey, each with additional opportunities to increase revenue and/or decrease cost.

The Bottom Line

We are at a very early point in the life of this poor data quality survey, which will run through the end of this calendar year, and then repeat annually. The interim results I’ve presented here are not surprising, but they will prove disappointing to data quality professionals. I hope they will motivate organizations to improve their data quality situation.

One takeaway at this stage is that InfoGov community professionals are eager to be heard about the data quality problems they experience and their associated costs. They want the world to know that data quality problems are still rife, and they are costing organizations and their stakeholders real dollars.

I will report on survey progress, aggregated responses, and additional insights as we enter Fall, and the relaxation of summer begins to fade.

Comments are closed.